Csrs retirement calculator

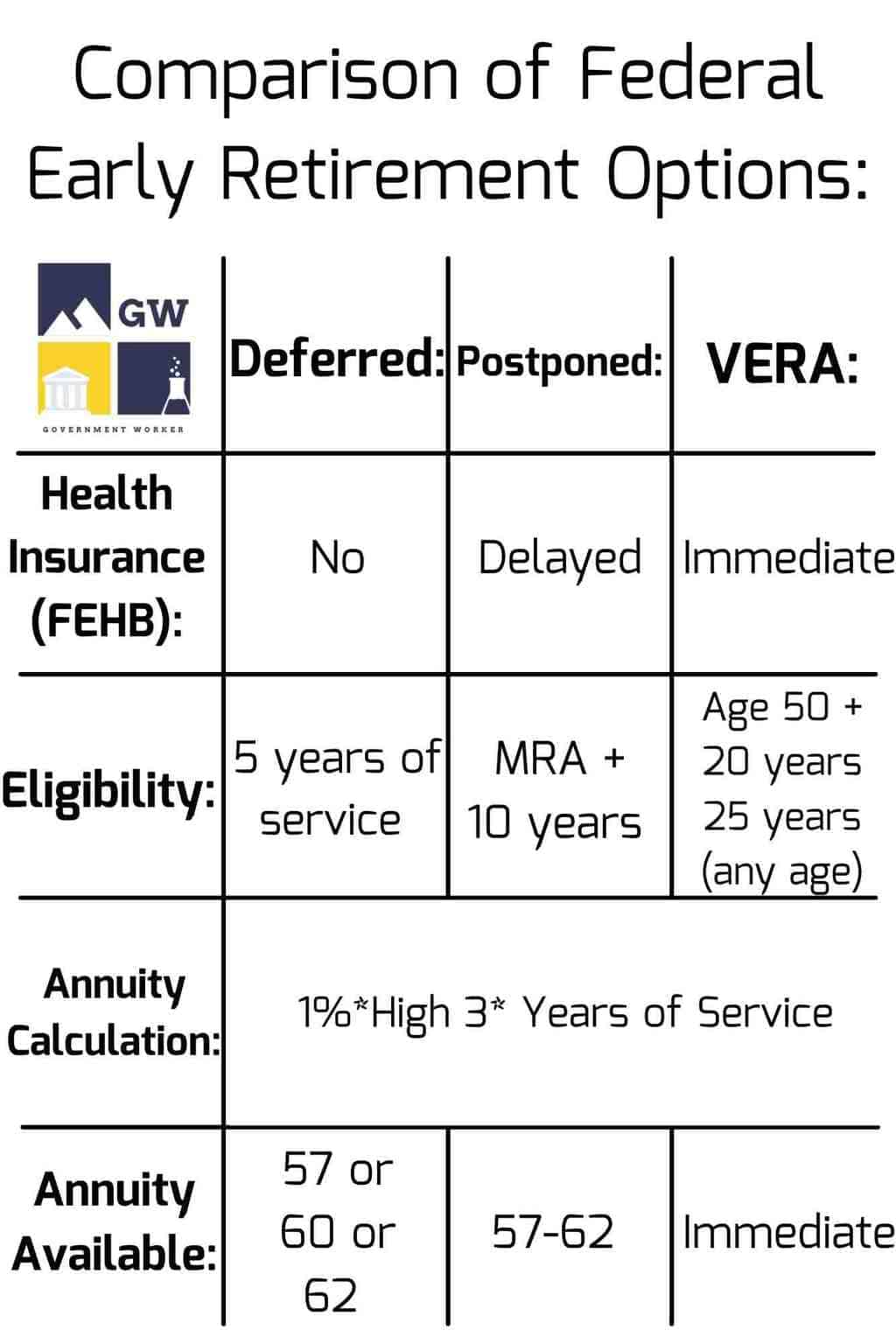

40 percent of your high-3 average salary or. And in a Postponed FERS Retirement you the option to resume your FEHB coverage into retirement.

Rheal Software

The regular annuity obtained after increasing your service by the time between.

. Note that Charles is also receiving a CSRS annuity component for his retirement. If your Online Calculator retirement benefit estimate is in todays dollars you can still use the Online Calculator. If you already know a bit about FERS Retirement Click here to learn more about the specific types FERS eligibility rules for retirement.

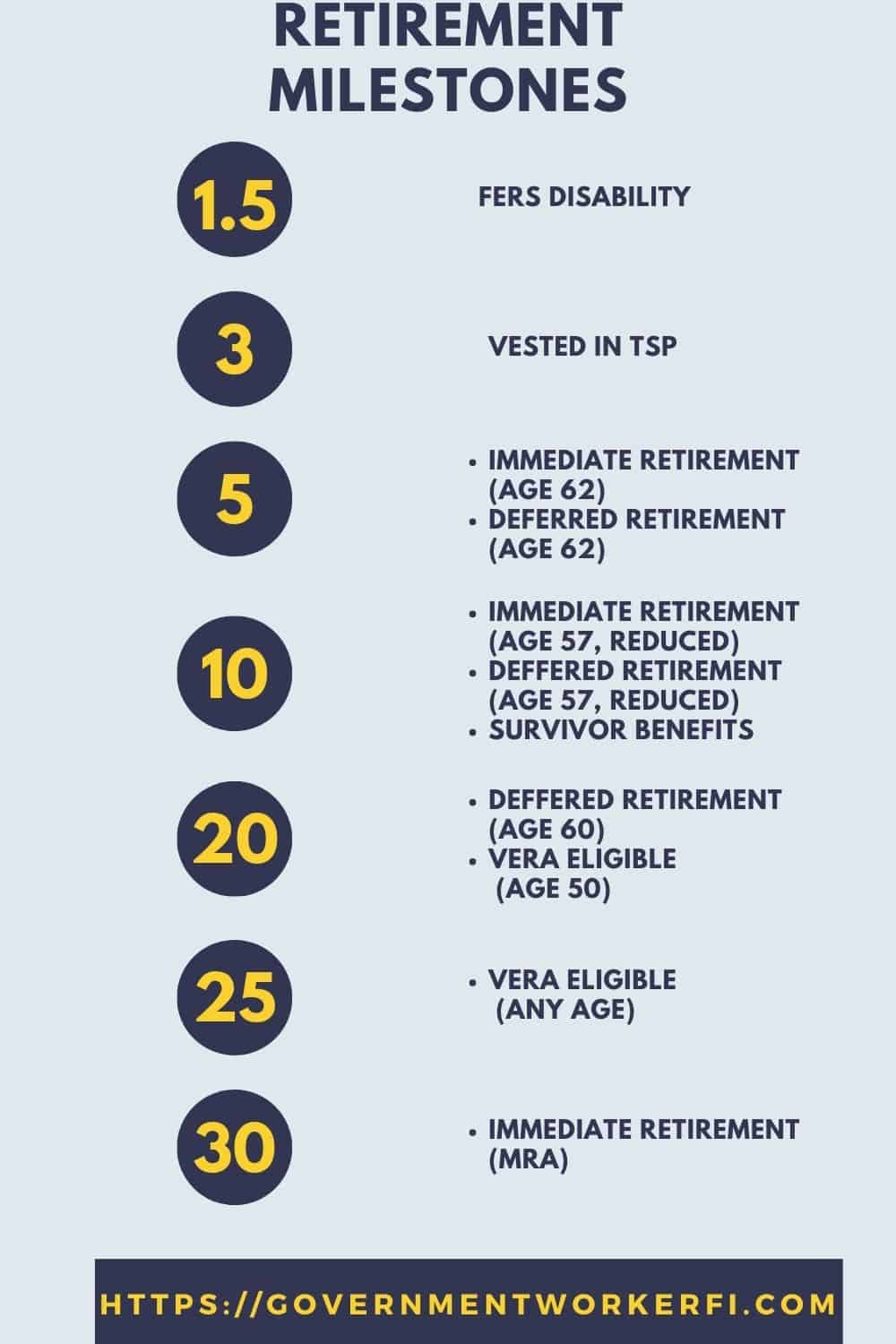

Its vested after three years of service and it does not automatically close upon retirement forcing a transfer of funds. But you do not have that option with a Deferred Retirement. To retire with a full annuity.

The standard age for retirement at the USPS is 65 and there are retirement plans placed under both Federal Employment Retirement System FERS and Civil Service Retirement System CSRS depending on whether service life began before or after 1984. Many CSRS annuitants are upset because they are being denied a full Social Security benefit in their retirement. It offers Federal civilian employees the same type of savings and tax benefits that many private.

The calculator below requires you to input the year your were born and your estimated age at retirement. But other retirement rules revolve around fixed ages like age 60 and age 62. This change would also eliminate the GPO and WEP offsets.

The Thrift Savings Plan TSP is a retirement savings and investment plan for Federal employees. However switching to the FERS Retirement Calculator system can provide them with full Social Security benefits including a FERS annuity. Next we will verify your FERS Eligibility to retire with a full annuity based on the current OPM guidelines.

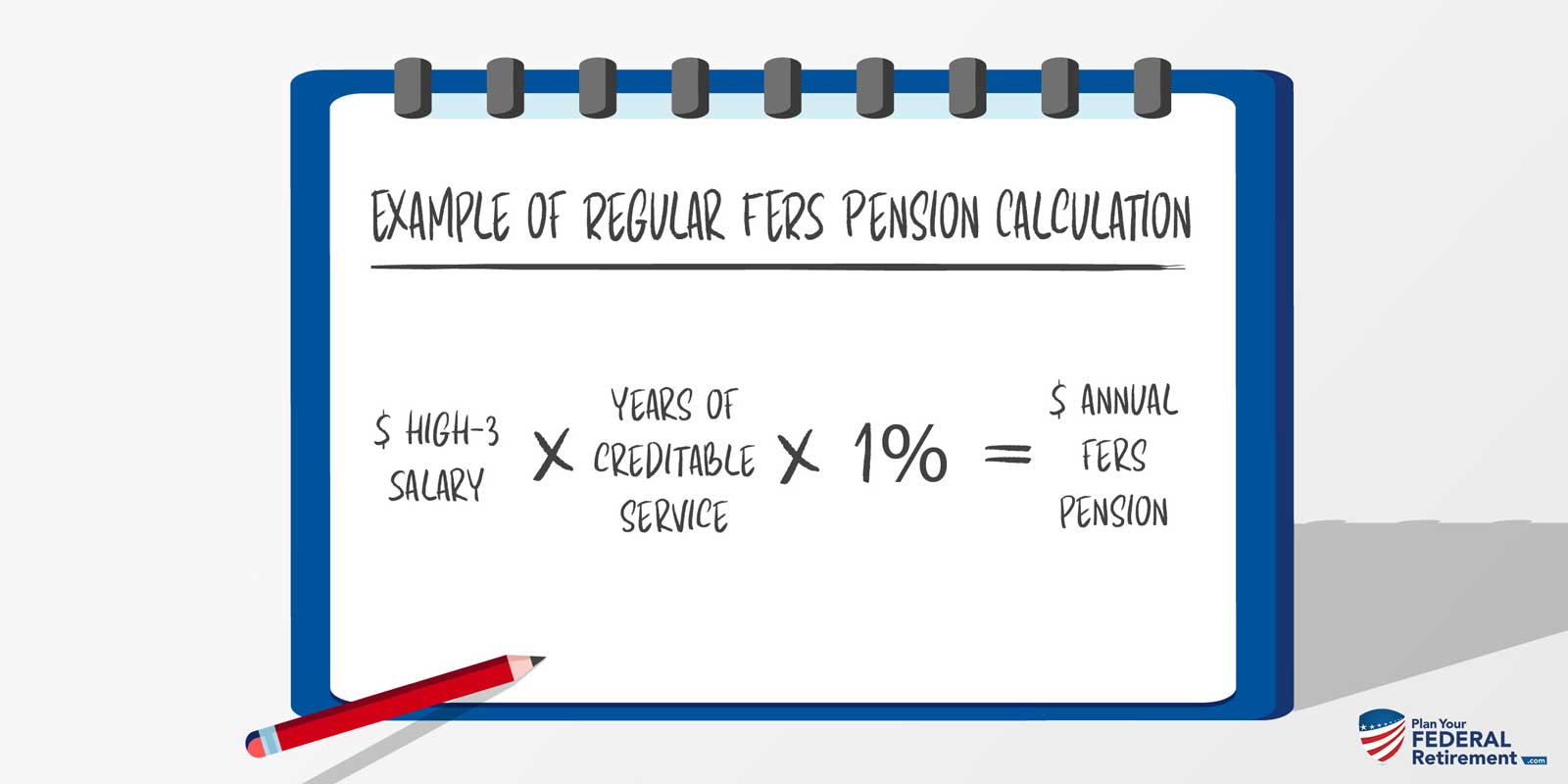

CSRS Offset The FERS Retirement Annuity. That 1 helps the government to ensure that FERS employees achieve a retirement thats comparable to that of CSRS employees. Employees share in the expense of the annuities to which they become entitled.

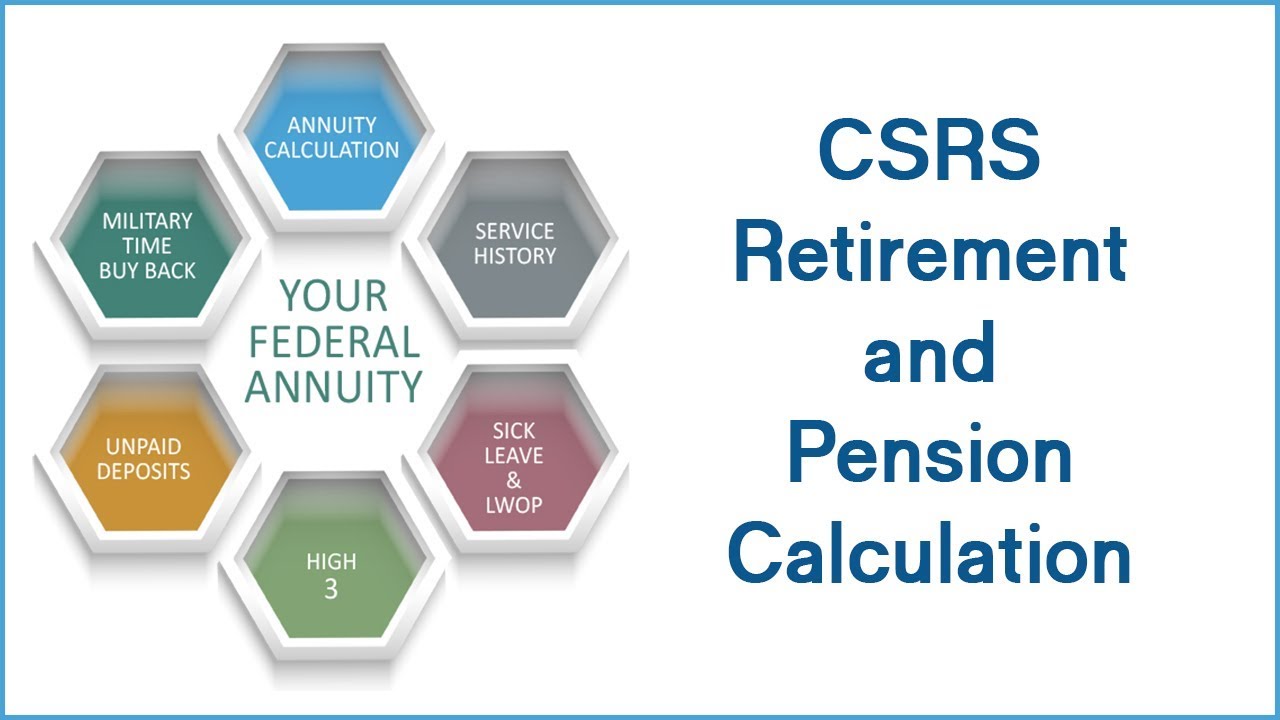

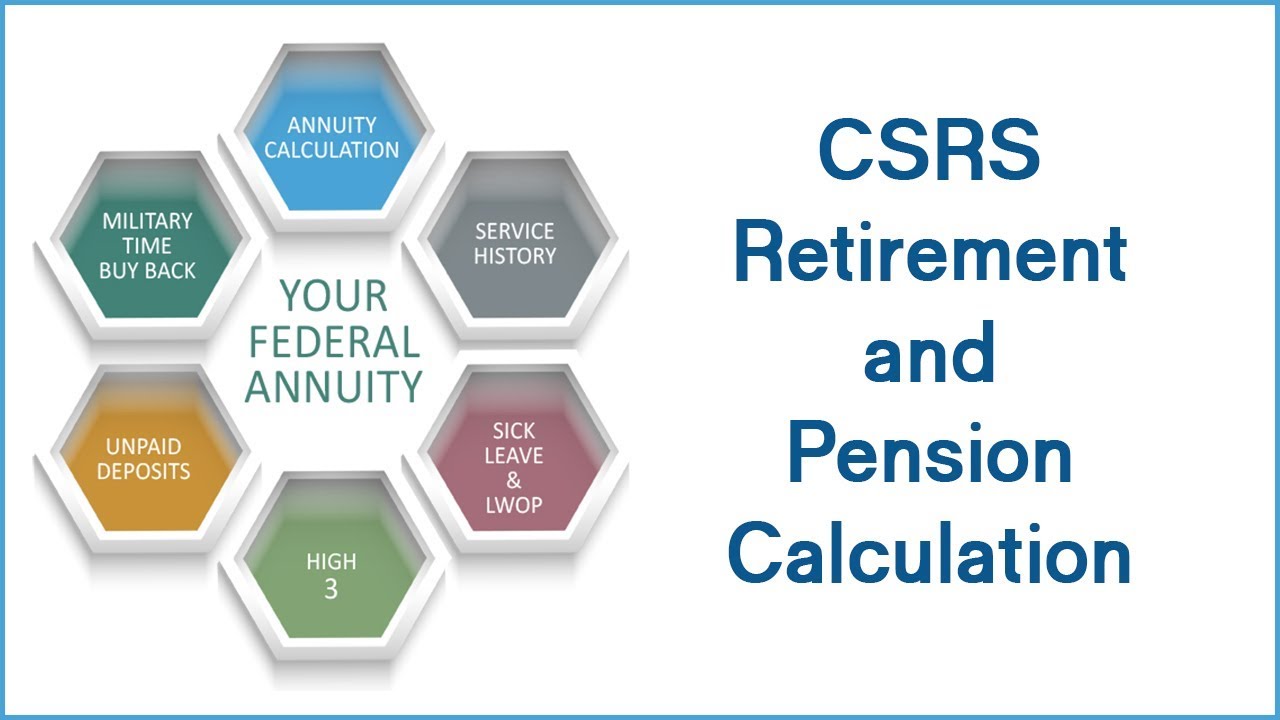

CSRS Annuity Calculator Includes early retirement deposits redeposits life insurance sick-leave adjustments and special rules for law enforcement firefighters and air traffic controllers. Lets take a look at both these systems to give you a clearer picture. FERS employees are eligible for a retirement annuity at the Minimum Retirement Age MRA with just 10 years of service.

Computation of Charles starting FERS annuity. Just go back to Todays dollars or future dollars select future inflated dollars and press the Calculate Benefit button to update your estimate. But if youre just starting to learn about federal retirement click here to go to our main overview page about FERS.

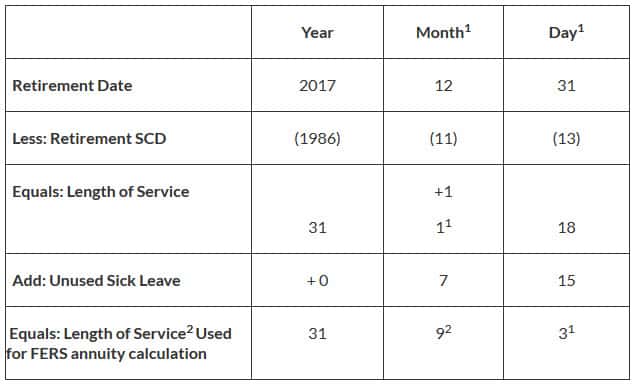

Your Minimum Retirement Age or MRA is the earliest age you are able to retire as a federal employee. If you retire for disability you may be guaranteed a minimum annuity equal to the smaller of. At the time of his retirement Charles had 20 years and 0 months of service used in the computation of his FERS annuity.

If Bob takes an MRA10 FERS Retirement now his FERS pension will be calculated as 100000 x 10 years x 1 10000year. The Amount Taken from Salaries. Use the WEP Online Calculator to calculate your estimated retirement or disability benefits.

However if you retire at the Minimum Retirement Age MRA with 10 service but less than 30 years of service your benefit will be reduced by the age reduction. Option 1 Bob Takes MRA10 Retirement Now With Reduced Pension. It was established by Congress in the Federal Employees Retirement System Act of 1986 and offers the same types of savings and tax benefits that many private corporations offer their employees.

The Thrift Savings Plan TSP is a retirement savings and investment plan for Federal employees and members of the uniformed services including the Ready Reserve. If you are eligible for Social Security benefits on your spouses record and a pension not covered by Social Security the Government Pension Offset or GPO may affect your benefits. The purpose of the TSP is to provide retirement income.

CSRS covered employees contribute 7 7 12 or 8 percent of pay to CSRS and while they generally pay no Social Security retirement survivor and disability OASDI tax. The Civil Service Retirement System CSRS is a defined benefit contributory retirement system. Assume Charles high-three average salary is 100000 then.

Find out the soonest possible date you can retire from Federal service and still receive an retirement annuity.

Csrs Fers Vs Calpers Vs Aarp Retirement Calculator Comparison Review Advisoryhq

Csrs Fers Vs Calpers Vs Aarp Retirement Calculator Comparison Review Advisoryhq

Fers Retirement Calculator How To Calculate The Fers Basic Annuity

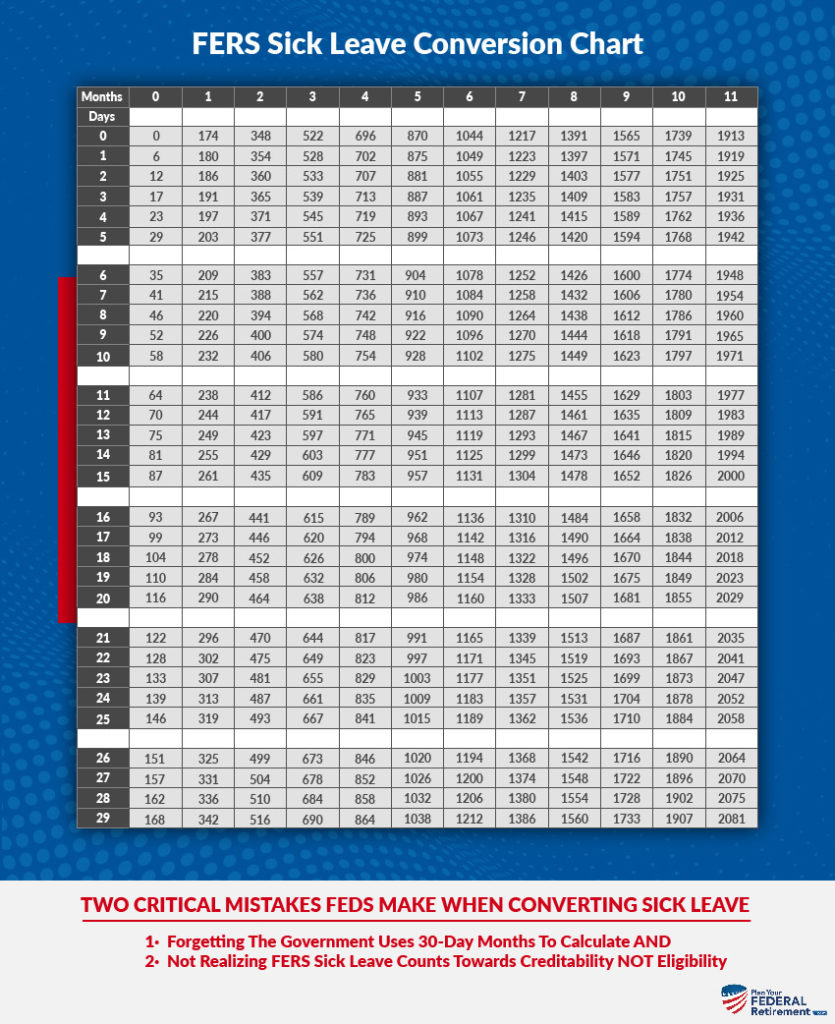

Grab Your Free Federal Employee Sick Leave Retirement Calculator

Csrs Fers Vs Calpers Vs Aarp Retirement Calculator Comparison Review Advisoryhq

Federal Retirement Calculator Fers Csrs My Federal Retirement

Csrs Retirement And Pension Calculation Youtube

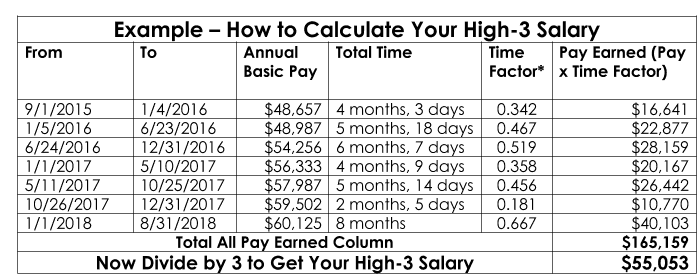

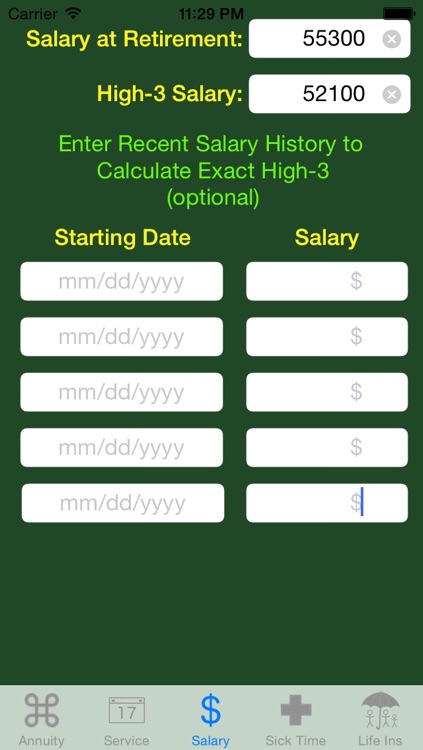

How To Calculate Your High 3 Salary Plan Your Federal Retirement

Fers Retirement And Sick Leave Plan Your Federal Retirement

Fers Retirement Calculator How To Calculate The Fers Basic Annuity

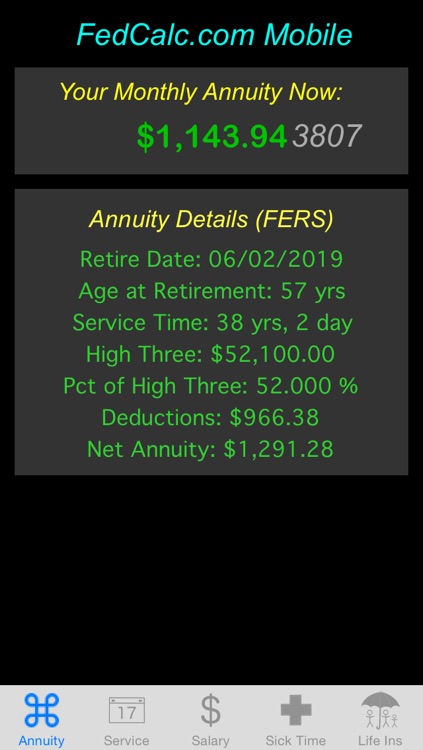

Fedcalc Fers And Csrs Annuity Calculator By Robert Caruso

Fedcalc Fers And Csrs Annuity Calculator By Robert Caruso

Calculating Service Credit For Sick Leave At Retirement

Grab Your Free Federal Employee Sick Leave Retirement Calculator

Your High Three Estimate In Our Fers Calculator Retirement Benefits Instituteretirement Benefits Institute

Federal Retirement Service History Retirement Benefits Instituteretirement Benefits Institute

Fers Retirement Special 10 Bonus Age 62 With 20 Years Of Service